What is Home Equity and how do you use it?

Tap into the borrowing power of your home with a Home Equity Loan.

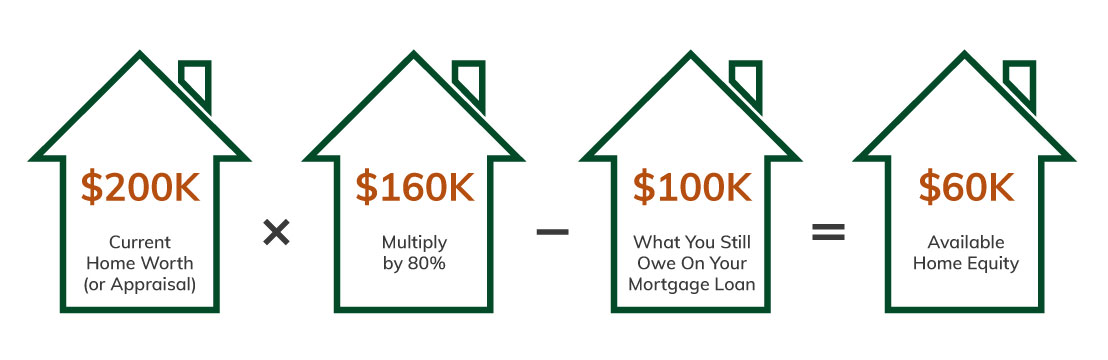

Homeowners may not realize how many choices they have for borrowing money. One of the options is a home equity loan, which lets you borrow funds against the equity you’ve built up in your home. You can use your funds for a variety of purposes, such as home improvement projects, debt consolidation or major expenses. There are two types of home equity loans, a fixed rate closed end Home Equity Loan (Lump-sum disbursement) or a variable rate open end Home Equity Line of Credit (HELOC) (Withdraw funds as needed).

.png?sfvrsn=40039519_0)